Today, it’s hard to imagine that desolate ride. The road, like most in the Senegalese capital, is tarmacked; there are roundabouts, street lights, traffic police and complex flyovers streaming with cars. Joggers trot along the palm-lined beach boardwalk. Hawkers still sell purified water to traffic jams in Bamako, Mali’s capital, but in Dakar it’s not worth anyone’s while anymore – they’ve probably upgraded to a grocery store with a refrigerator instead.

The carts have largely disappeared, too, re-emerging during transport strikes in January when a headline in the country’s L’Observateur newspaper declared: “Dakar returns to the dark ages.” Although the Dem Dikks are still crammed, there are long buses with ceiling straps and seated conductors who take your 150 CFA francs (18p) from behind a wire grille. Taxi drivers, while charging CFA 3,000 (£3.60) rather than the going rate in 1998 of CFA 500 (60p) for a ride into town, will tell you that where regular hooting was once practically compulsory, Dakarites have quietened down. “Hooting is as important as the brakes in Africa,” one says cheerfully. “But Dakar drivers are learning to be polite.”

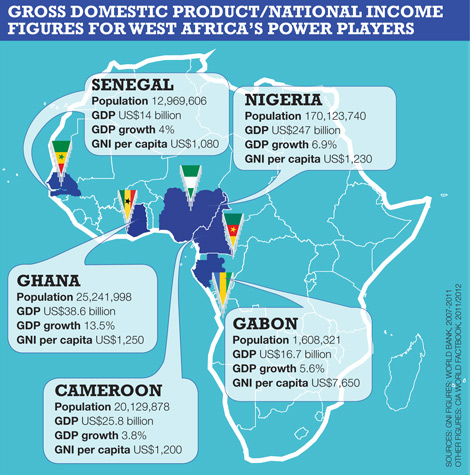

Senegal is a big player in West Africa’s burgeoning economy, with a stable democracy – despite the recent wobble that saw demonstrations against now ousted president Abdoulaye Wade – that holds major political clout with the Economic Community of West African States (ECOWAS), the African Union, the New Partnership for Africa’s Development (NEPAD) and the UN.

With a GDP growth rate of 4 per cent, it’s no surprise that along that road you pass air-conditioned supermarkets, Shell garages, a shopping mall and a Radisson Blu. Apartments have sprung up on land whose value has grown fivefold in the past decade. And Youssou N’Dour, now Senegal’s minister for culture and tourism, has moved to Les Almadies, where all the celebrities live. West Africa is growing up – fast.

Power players

Further south, Nigeria forms West Africa’s economic powerhouse, fuelled by oil wealth. Unfortunately, its economic brilliance is hampered by political unrest, a lack of infrastructure and crippling corruption. The world’s seventh-largest exporter of oil is not filtering its wealth down to the 70 per cent of the population living below the poverty line – instead, a wily minority forms a group of extraordinarily rich Nigerians.

Still, the business outlook is positive. GDP growth stands at 6.9 per cent and it’s the second-favourite country in Africa for UK exporters, according to Barclays’ Trade with Africa report, published in April. Heineken and Diageo have operated there for some time and Radisson Blu is planning five new hotels in Lagos and Abuja. Chains such as Walmart and Mango are flooding in.

“The biggest growth industry is consumer goods,” says Jaco Maritz, publisher of online business publication How We Made It In Africa. “There will be up to 700 supermarkets in Nigeria in the next few years. Property, agriculture and financial services are also booming.”

Oil finds in Ghana, alongside gold mining, made it the world’s fastest-growing economy last year (see panel, page 56). It has a GDP growth rate of 13.5 per cent, and the International Civil Aviation Organisation forecasts passenger growth in West Africa of at least 8.3 per cent over the next two years, driven by business travellers. No wonder Easyjet founder Stelios Haji-Ioannou has announced plans for a low-cost carrier linking Ghana to six other West African countries.

“Ghana’s success is backed up with political stability, a high level of security and a lower level of corruption compared with Nigeria and Ivory Coast,” says Markus Lueck, general manager of the Kempinski Gold Coast Hotel Accra, opening in the capital in December. “Nigeria has been the centre of attention, but there’s a shift that will make Ghana the business hub in West Africa within the next five to seven years. It’s less risky and more promising for future business ideas and set-ups.”

There are two regional stock exchanges, in Abidjan, Ivory Coast, and Libreville, Gabon, the latter of which is home to the brand new Nkok special economic zone, some 48km outside the hectic capital. It’s so swish it wouldn’t be out of place in Silicon Valley, and investors – including ECOWAS countries, the US and Singapore – hope it will harvest US$1.1 billion per year in foreign direct investment in the country’s rich mineral deposits.

On a smaller scale, there’s Cameroon, with GDP growth at 3.8 per cent. And before this month’s military coup, Mali’s Bamako was one of the world’s fastest-growing cities, with a 5.4 per cent annual urban growth rate. On every corner, masons teeter on wooden scaffolds, hammering at concrete buildings rising from the sand. There’s a new business district – ACI – and a new bridge across the Niger. Dusty, landlocked and swelteringly hot, it has transformed from village to exploding city in 15 years. It will, at 2011 estimates, count three million upwardly mobile inhabitants by 2020, meaning the political and economic situation should be closely monitored.

“Those who have heeded the clarion call to invest in Africa have success stories to tell, especially in the telecommunications, oil and gas, banking and consumer goods sectors,” says Henry Egbiki, West Africa regional leader at Ernst and Young. “The flow of investments has been steadily rising in power, energy, extractive industries, healthcare and agri-business. There are still concerns about political stability, corruption and a low level of infrastructure, but with these risks also come high returns on investment.”

Consumer culture

West Africans are entrepreneurial, creative and interested, prone to debating politics on the beach and at the newspaper stand. There’s a growing middle and intellectual class – it’s estimated that Africa’s middle class will expand from 313 million to almost a billion in the next decade.

Chic mothers in Dakar drive to the gym while their kids are in school. Stylish, tech-savvy students are as likely to be found in jeans and trendy T-shirts as they are in a traditional boubou (sleeved robe). They go skating and surfing in their free time, text their mates and save up for a moped and a university degree, seamlessly blending a quick yassa poulet with clubbing to the rolling beats of traditional djembé drums.

Educated women are demanding that their spouses have just one wife. Everyone tucks into thiebou-djenne (rice and fish) at lunchtime, but many do it in shiny offices and restaurants. Here is a society of consumers hungry for TVs, laptops, mobile phones, fridges, cars, scooters, fashion, beauty and fast food.

New roads are being built (often by the Chinese), ports modernised and fibre optic cables laid. Investment by mobile phone companies has seen a tech revolution. Nowadays it’s not surprising to find a Fulani sheep herdsman with a mobile, while ladies selling necklaces will stop to answer a call. Top-up credit is sold in stores and by enterprising boys on the sides of roads.

Real estate is soaring. Once you could buy a house on Dakar’s pretty Ngor island for around CFA 10 million (£12,000); now an average beach house will set you back a cool CFA 75 million (£91,740). A survey earlier this year by Nigeria-based W Hospitality Group reported a 42 per cent rise in planned new rooms by hotel operators in sub-Saharan Africa, led by Radisson Blu, Hilton, Ibis and Movenpick.

We cannot idealise. Africa’s problems are still there, not least in the western region – drought, disease, hunger and unemployment, endemic poverty, multi-level, multi-faceted corruption, a disappointing lack of infrastructure, unstable governments and too many rural and urban populations who live on less than a dollar a day. It remains by far the poorest continent on the planet. But much as the global media would like to paint it as a desperate place, it’s not as simple as that, and private sector development is critical to pushing economic growth and reducing poverty and inequality.

“Africa is growing – but people shouldn’t lose sight of the reality that it’s still a very undeveloped market,” Maritz says. “Investors should have a long-term outlook and count on five to ten years to see real, solid profits.”

Time to invest

British investors are late to the game. China has been injecting huge volumes of money into West Africa for years and Brazil, India and Russia are following suit. The butterfly effect in this part of the world is tangible. In Dakar, Chinese traders selling imported goods in Sandaga market are credited with affecting trade down into the Gambia, as Dakarites stop travelling across the border to Banjul to buy cheap presents for the annual festival of Tabaski.

Every upwardly mobile Malian living in Bamako owns, or is saving up for, a Chinese-made Power-K motorbike. Africa represents the last great open market, but Britain does not even have an embassy in Gabon and, while pursuing an aggressive aid programme, it’s cautious about investment in the region.

Kah Chye Tan, global head of trade and working capital at Barclays, says the potential for UK producers in Africa is significantly underestimated: “This is a ‘ground floor’ moment in many African economies, in which UK suppliers have the opportunity to build their brand in Africa at a time when a growing middle class is beginning to make long-term brand decisions. The UK should not be missing out.”

There’s no doubt West Africa is a complex place to do business, not least because of the economic and cultural set-up. ECOWAS unites 15 countries in a peacekeeping and economic union – Benin, Burkina Faso, Cape Verde, the Gambia, Ghana, Guinea, Guinea-Bissau, Ivory Coast, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo. Most are francophone, with a scattering of anglophone countries. Eight (Benin, Burkina Faso, Guinea-Bissau, Ivory Coast, Mali, Niger, Senegal and Togo) form the monetary and customs union of the UEMOA and share a currency, the CFA franc.

Then it gets complicated. There are more than 1,200 native languages spoken in Africa. Although the figure is not known specifically for West Africa, myriad local dialects and languages are used across the region, from Wolof in Senegal to Bambara in Mali, Twi in Ghana and Igbo and Yoruba in Nigeria, all bringing with them specific customs.

Meanwhile, Muslim and Catholic religions are coloured by ancient African practices; many people consult a marabout (spiritual advisor) and many wear magic charms, or gris-gris. When a new house is built in Bamako, most masons will cast a good-luck spell on its foundations. If you’re invited for lunch at one of your colleague’s houses, expect to eat from a common dish. When taking tea, you’ll be expected to drink that third, super-sweet glass.

Such customs are not to be taken lightly, Maritz says. “Understand that it’s not like a Western market. Familiarise yourself with the local way of doing business – for example, after a presentation, you won’t get an answer straight away. People like to go away and think about things.”

Egbiki believes there is much to learn from such a diverse environment. “Investors can learn from the region’s ability to unite different ethnic groups, migrant populations, traditional and modern leadership, honouring and respecting chieftaincy while promoting the development of the continent via modern technologies,” he says. “West Africa’s ability to build coalitions within society – chiefs, churches, politicians, businessmen and women – is indicative of its adaptability and determination to place the region in the world.”

The African way

Let’s face it, there is an African way of doing business. Combine a lack of infrastructure, road systems that leave much to be desired, few business hotels beyond the capitals, frequent power cuts and formidable groups of powerful village elders, and you have a very challenging business environment. You may end up sitting in traffic for hours to get to a meeting – and facing innumerable bribes.

“Be flexible and patient,” advises Andrew McLachlan, vice-president of business development, Africa and Indian Ocean Islands for the Carlson Rezidor hotel group, which operates in Mali, Senegal, Gabon, Nigeria and, soon, Sierra Leone, Guinea and Ghana. “Doing business in Africa is either full steam ahead at 100 miles per hour or in reverse. Nothing’s constant and on time.”

Corruption presents the biggest challenge. It remains the biggest single issue for British exporters, followed by poor payment systems and infrastructure. Four years ago Dakar expat Marta Imasario, from Italy, set up Malika Surf Camp (malikasurfcamp.com) in the seaside Yoff district, offering accommodation and surf lessons to tourists. She says negotiating the local language of Wolof was the least of her problems when applying for papers.

“The man at the desk told me every day that I should come the next day,” she laughs. “And the next day again, and again… Then I realised he was saying, ‘Pay something to accelerate this.’ In Senegal they say that either you pay or you smile, but if you pay one time, they’ll always knock at your door. So I decided to ‘smile’ at the authorities and waited six months. There are no standard procedures, and this can open the door to corruption. My best advice is, don’t be in a hurry.”

McLachlan adds: “Check how much basic supplies such as water and electricity will cost. Local labour costs less, but allow for more training and supervision. It’s a good idea to have a local partner who knows the lie of the land and can navigate you through local pitfalls.”

West Africa is a new world of business, presenting opportunities for those brave enough to take it on. One day we’ll open this magazine and read about the next luxury West African boutique hotel, the latest prize-winning African entrepreneur and the most recent African election running without a hitch. Let’s hope that one day this will no longer be a surprise.Top tips for investors

Henry Egbiki, West Africa regional leader at Ernst and Young, says:

West Africa is a complex market. To navigate its risks and capitalise on its opportunities, investors should:

- Make sure there is a good fit between your long-term vision for your business and the area in which you want to invest.

- Identify skilled, trustworthy people who understand the environment and can help you to navigate complex terrain.

- Spend time getting to grips with gaps in local accounting systems and business models.

- For potential investors, a positive mindset is just as important as understanding the challenges – it’s a case of whether you see the risks and challenges or the opportunities and return on investment.

Case study: Nigeria

In 2014, Nigeria is expected to overtake the UK as the largest market for Guinness in the world. It’s not the only sector that’s booming. Kempinski, Marriott and Wyndham are all aiming to enter the Nigerian hotel market for the first time. The number of stock exchange-listed domestic companies, such as Alitheia Capital, has risen to 215 and it’s a top destination for Chinese investment.

“Ernst and Young recently carried out a survey of the world’s rapid growth markets,” says Henry Egbiki. “The survey came up with four in Africa. Of those, two are in West Africa – Nigeria and Ghana.”

A recent survey of the Nigerian middle class by investment bank Renaissance Capital shows a budding society of consumers, ripe for the picking by those retailers, estate agents and banks brave enough to take on its overly bureaucratic system and endemic corruption. But it remains to be seen whether President Goodluck Jonathan can solve the problems of the country, which seems only to have struggled with tribal conflict and terrorism since his inauguration last year.

The survey asked 1,004 middle class Nigerians (70 per cent of whom were aged 40 or younger) in Lagos, Abuja and Port Harcourt with an average monthly income of N75,000-N100,000 (£298-£401), a typical professional salary, about their spending habits. Most were educated to a post-secondary degree, in full employment, with a bank account. Most had a fridge and DVD player and 25 per cent planned to buy a microwave, washing machine or dishwasher in the coming year. Television (98 per cent) and radio (95 per cent) were the most popular sources of information, while 78 per cent read newspapers and 48 per cent used the internet. Many aspired to be home owners.

The question is, can Nigeria transform from a minority bickering over oil wealth to a stable, positive prospect for foreign investment? Egbiki believes it can: “The recent banking reforms of the Central Bank of Nigeria are a case in point, where bank CEOs were sacked, tried in courts of law and some jailed for mismanagement and fraud. In the public sector, procurement policies have been reformed to leverage the World Bank or International Monetary Fund model. With sustained commitment to fight corruption, I’m sure it will be curtailed, if not eliminated.”

As Lueck puts it: “Foreign investors need to ensure that they stay ‘clean’ when doing business in West Africa, so that a clear message is given to local leaders that corruption will not be tolerated.”Case study: Ghana

Movenpick Hotels and Resorts opened in Accra in 2010. Stuart Chase, general manager of the hotel, says excellent air links between the UK and Ghana (BA flies daily to Accra, while Virgin Atlantic flies five times a week) and its status as the world’s fastest-growing economy make the country an attractive prospect.

“There is tremendous growth in nearly all sectors,” he says. “The recent oil and gas discoveries have led to a large influx of international as well as Nigerian companies, and many are still in their start-up phases. With its history of stability, Ghana is seen as a safe beacon.”

High global prices for gold and cocoa have aided growth, and technology, telecommunications, insurance and banking sectors have been doing well and using the country as a hub for trading in the region. The Ghana Investment Promotion Centre recently announced that it had registered 514 projects in 2011, at an estimated value of US$7.68 billion, against 385 projects in 2010, worth US$1.28 billion. Those of Chinese origin dominated with 79, followed by India with 77, Nigeria with 39 and Lebanon 36. In terms of the estimated value of the projects, Korea topped the list with US$4.77 billion.

Chase says relationships are important when doing business here. “As many of the key personalities have been educated or worked abroad, we doubt that there is any cultural skew on the way people do business,” he says. “Similar to the West, a great deal of business is done based on relationships, networks and, to a certain extent, on family connections. Treat the region as you would a first world trading environment; do not underestimate the experience, education, business acumen and knowledge to be found in the region as a whole.”

Ghana can learn from the mistakes of its neighbours, says Chase, with its population placing enormous expectations on these lessons reaping high rewards. “In Ghana, corruption is becoming less of an issue as more companies and investors are attracted to the region,” he says. “Zero tolerance by the government and a positive attitude to dealing with international reputable organisations has led to a more mature and acceptable way of doing business along the same lines that you would find elsewhere.”