Alex McWhirter examines topical business travel issues

European governments are continuing to exploit air passengers as “cash cows”. In a bid to fund its budget deficits, the UK government is hiking Air Passenger Duty (APD) yet again this month, while Germany will impose controversial taxes on air travellers from the New Year.

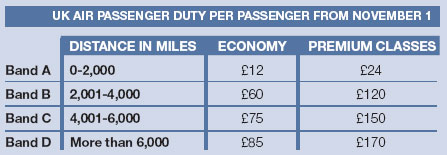

The UK’s APD was first introduced in 1994 and charged simply at £5 for short-haul and £10 for long-haul flights. Since then it has become more sophisticated and much costlier. Departing passengers are now charged in four “distance” bands and according to whether they buy economy or premium fare – defined as premium economy, business or first class – tickets (see table below).

Not surprisingly, the new rates are highest on longer flights. There may be higher departure taxes than the UK’s, but I can’t think of an example (answers on an email – [email protected]). APD on a London-New York ticket rises from £45 to £60 in economy and from £90 to £120 in business. Fly to Singapore or Sydney and the rates increase from £55 to £85 and from £110 to £170.

What the aviation industry particularly dislikes is the way the government views premium economy as a luxury product along with business or first class, so the rate of APD is no different. This does nothing to help the cash-strapped executive looking to downgrade but seeking an acceptable level of comfort. Thomson Airways, the first UK customer for the B787, says it may not now install premium economy seating on it because of the higher APD rates.

Chris Browne, the carrier’s managing director, says: “We would love to offer a premium economy service [on the B787] but [because of the higher APD] we will be forced to consider having one class onboard.”

Simon Buck, chief executive of trade body BATA (the British Air Transport Association), says: “Increases of up to 50 per cent will do nothing to encourage passengers to take premium economy. It sounds the death knell in the UK market for a product pitched midway between business and economy.”

Meanwhile, passengers departing airports in Germany from January 1 will pay €8 for domestic and inter-European flights, €25 for medium-haul and €45 for long-distance flights. Germany’s so-called “eco” tax is expected to raise e1 billion a year, but the revenue will go straight into government coffers.

Giovanni Bisignani, chief executive of trade body IATA (the International Air Transport Association), says: “It’s a tax grab by a cash-strapped government. Painting it green adds insult to injury. There will be no environmental benefit from the economic damage caused.”

Lufthansa is strongly opposed to the new tax. It says: “As Germany’s largest carrier, Lufthansa will be particularly hard hit by the tax. The relationship between the level of tax and distance flown will put Germany – a leading export nation that relies heavily on global connections – at a special disadvantage. The tax will give momentum to foreign airlines and airports, as the experience in the Netherlands has shown.”

As we previously reported (see “Back on track”), the Dutch government imposed a similar eco tax in 2008 but had to scrap it a year later. That was because passenger numbers fell at its main Amsterdam airport as canny passengers avoided flying from Holland and chose airports in nearby countries instead. “Schiphol lost an estimated 1.3 million passengers as a result of the eco tax,” an airport spokeswoman told Business Traveller. The same might happen again with airports in Benelux and Switzerland welcoming German travellers.

With the UK being an island, it is much harder to avoid the highest rates of APD unless travelling on separate tickets. But that presents its own problems because passengers may not be able to through-check and the chances are there will be no saving. That is because the onward ticket must be bought in another currency and because London is renowned for being Europe’s cheapest long-haul springboard.

For example, in early December singaporeair.com quotes £708 for a London-Singapore economy return, whereas the same Singapore Airlines ticket for Paris-Singapore would cost €1,155 (£1,009). In business class the prices are £3,644 and €3,980 (£3,476) respectively, but remember that you must still add the cost of getting to and from Paris.

The UK’s coalition government has indicated it wants to scrap APD in favour of a flat tax per flight. This might alleviate matters for some passengers, but at the time of writing there was no indication of how this new tax would be applied or when it would take effect. Maybe the October 20 budget will have provided the answers.