Not everyone has come off badly from the recession – budget and limited service hotels are booming. Michelle Mannion provides an update

Let’s be honest – given the choice, we would rather stay in a super-luxury hotel with all the trimmings. Personal butler? Check. Michelin-starred cuisine? Check. Super-sleek spa with masseurs on call to ease away every ache and pain? Yes please.

But for many business travellers, the reality is more likely to be a roadside chain or an airport bolt-hole – what’s more, since the recession, staying in high-end properties has often become the exception rather than the norm. As a result, demand for properties at the other end of the scale is growing.

For Trevor Elswood, group managing director of hotel booking agency BSI, this demand started long before the downturn. “We’ve seen pretty consistent growth in the sector year on year – there’s been more of an emphasis [on budget brands] as a result of the recession, but even in the [economic] heyday there had been steady growth.” Between 2005 and 2009, BSI’s economy hotel business grew by 41 per cent, he reports.

Defining what constitutes a budget hotel is becoming more and more tricky, especially as it’s a term not all chains like to apply to themselves, fearing negative connotations. Also, as many of the mid-market brands have dropped their rates to combat the downturn, the price differential isn’t as marked. What’s really making it harder, though, is that the lower-end brands have raised their game to compete with more upscale properties. “The product has really hit the button,” Elswood says. “It has evolved to meet the comfort and safety needs of the corporate traveller, and as a result companies are more inclined to [mandate them].”

Their services have certainly extended far beyond what one might expect. Wifi capability is now usually a given – and is often free, something many higher-end properties do not offer (see panel, page 49). Many will have a dining offering on-site and even meeting facilities, while in-room you can frequently find king-size beds, good power showers and flatscreen TVs with Freeview. So while ChesterSimons, a contributor to our online forum, expressed doubts about the location of a Premier Inn he recently stayed in, he said of the room: “You know what? I could have been in any decent four-star bedroom in any hotel in the world.”

Still, they remain differentiated by a lower level of facilities, guest services and room amenities. So while you will generally be able to make a cup of tea or coffee, don’t expect to find a minibar or to be able to call for room service. Here we take a look at the big budget chains as well as those brands that come under the limited services banner – hotels that are increasingly focusing on their room offering but keeping costs down by not providing a full-service restaurant.

The UK giants

For anyone who doubts the power of budget brands, consider that the UK’s two biggest players, Premier Inn and Travelodge, operate more than 1,000 hotels between them. Premier Inn has almost 600, totalling just over 42,000 rooms. “We have plans to get to 55,000 in the next four years, which we’re on track to do – that’s somewhere in the region of another 200 hotels,” says marketing director Gerard Tempest.

Travelodge has 30,500 rooms across 456 hotels and has just opened its 34th London property in Waterloo. It plans to open 18 more in Greater London by the 2012 Olympics, including in Stratford (next year) and the Excel centre (2012), with a big extension to its Covent Garden hotel being completed next year. “We have 15,000 rooms sitting in our pipeline and our plan is to get to 70,000 by 2020,” says chief executive Guy Parsons. Some 35 per cent of Travelodge’s revenue is from business travel, while for Premier Inn it’s 55 per cent.

“The recession has been interesting for budget hotels,” Parsons says. “While sales went into decline, it was nowhere near as bad as for the rest of the industry. What we’ve seen is a number of big firms mandating that budget hotels are the only things people can now get signed off.”

It also meant Travelodge could pick up prime sites that it wouldn’t have been able to before. “As the recession began to bite, developers came back to us and said: ‘Here’s a site, would you be interested in opening a hotel?’ We’ve got one right in the heart of the City opening in early 2012 [London Bank Travelodge]. That’s one that, ordinarily, we couldn’t have opened.”

For both brands, providing a good night’s sleep is a major part of their strategy. Premier Inn will give you your money back if you don’t get one – according to Tempest, only a “tiny proportion” of guests claim – while Travelodge has recently replaced all its pillows and introduced “sleep wardens” across its properties with the power to eject noisy guests.

This may suggest it has a rowdy element of customer that needs to be controlled, but Parsons insists this isn’t so. “Take Brighton Central,” he says. “We know it’s a party place, and we have a hotel about 50 metres from the sea. There is a club, cinema and pubs all around it and seagulls squawking overhead. But last year that hotel had not a single complaint.”

What both brands claim is that they offer the amenities business travellers actually need and keep costs down by stripping out the things they don’t. This meets the approval of businesstraveller.com forum contributor TomBaum: “If I have been driving on my own for ten hours, it’s 10.30pm and I need to be back on the road again at 7am, why pay for extensive facilities I will never use? All I require is a clean room, tea and coffee-making facilities, a comfortable bed and a suitable shower/bathroom. I do not need 24-hour room service, an in-room spa, express laundry or a choice of five restaurants.”

Travelodge’s Parsons says: “The whole ethos is to keep the room rate as low as possible, because not everyone wants to use all of the other facilities, and then charge on top.” With extras you can add when booking including cancellation insurance (£1.50, which you have to deselect or end up paying for), early or late check-out (£10) and text message confirmation (15p), the chain is taking on the pricing model of the low-cost airlines. “But I think we do it in a much more transparent way [than the budget carriers],” Parsons says. “I think we’ve got everything business travellers need and nothing that they don’t.” Still, guests who have to call reception for a hairdryer may not agree with where the brand draws its lines.

One criticism often levied at budget brands is inconsistency, particularly between older properties and new-builds. Tempest says this is something Premier Inn is striving to get right: “A typical hotel refurbishment cycle is probably every seven years, but because we run our business at much higher levels of occupancy and we have our sleep guarantee, we refurbish every bedroom every three years.” But note that when it comes to things such as food and drink, both brands’ offering will vary depending on the location.

Of the two, Premier Inn has more ambitious overseas plans. It has three hotels in Dubai, one in Bengaluru and one at Dublin airport, with plans to expand further in the Middle East and India. “There’s a real opportunity for budget hotels to grow quickly in those markets,” he says. A New Delhi property is due to open later this year, with Abu Dhabi to follow early next year. He says that while the product does have to be adapted to meet cultural expectations, it’s “more of a tweak than a big change”.

Travelodge has three hotels in Spain – one in Barcelona and two in Madrid – with three more, in Valencia, Seville and Barcelona, due to open by next year, but currently has no other plans to expand beyond the UK.

The multinationals

Around the world, the major hotel groups have all been pushing or launching lower-end brands to attract travellers on a tighter budget. Accor is particularly active, with three budget offerings. Ibis is the largest with more than 800 hotels, including 54 in the UK – it will add one in Aberdeen and another in Gloucester in December. Several are also set to open in China this year, as well as in Mumbai, Bangkok, Bahrain and Russia.

“The economy sector is where we’re going to continue to develop our network, particularly in continental Europe, the Middle East and Asia-Pacific. This is where we’re seeing the growth and, from a business travel perspective, we see a real opportunity to capitalise on the fact that corporates are still cost-cutting,” says Jo Stevenson, Accor’s director of sales for UK and Ireland.

A couple of years ago it launched All Seasons as an alternative to the standardised Ibis brand. Now numbering more than 90 properties in Europe and Asia-Pacific, it made its UK debut last year with the All Seasons London Southwark Rose. Positioned as a two- to three-star offering above Ibis, internet access, breakfast, tea, coffee, water and newspapers are included in the room rate. “The plan is to increase the network to 200 hotels worldwide by about 2015,” Stevenson says. The third brand, Etap, sits below the other two and is what she calls “a bit more blue-collar worker”.

Hilton is busy pushing its budget Hampton by Hilton brand, which has nearly 1,800 properties in the Americas, into Europe. Its six UK hotels include ones in Liverpool and Birmingham, with two more to open this year, and Berlin is set to get one next month. Its Hilton Garden Inn brand, aimed more at the mid-market, launched in the UK at Luton airport in 2008 (visit businesstraveller.com/tried-and-tested for a review).

Mark Nogal, Hilton’s regional head for focused service brand management in Europe, the Middle East and Africa (EMEA), says: “We’re looking at the primary and larger secondary cities in key target countries so we can build awareness for both brands. India and China are huge for us, and we’re looking at city centre as well as suburban and airport locations in the UK.”

Features of the Hampton by Hilton brand include free breakfast and internet access, an area in the lobby for web surfing or printing a boarding pass, and – unusually for a budget offering – a small gym.

At Intercontinental Hotels Group, Holiday Inn Express is benefiting from the £650 million rebranding taking place across all of its 2,090 hotels as well as the Holiday Inn portfolio. “We’re 75 per cent of the way through and our goal is to finish by the end of this year. We’re not only refreshing the branding but de-cluttering the hotels, making them stylish with clean lines,” says Jane Bednall, IHG’s commercial vice-president for the UK and Ireland. For Holiday Inn Express, that also means a new offering of four pillows per bed (two firm, two soft) and a “refreshed bathroom experience”.

About 500 new Express hotels are also in the pipeline, she reports, including 46 in Europe, the Middle East and Africa, and 16 in the UK. In June it signed properties in Hamburg and Istanbul.

No limits

Further up the scale, Starwood’s Aloft is an example of the new breed of limited service hotel. Launched in June 2008, the “style at a steal” brand now numbers 42 properties, mainly in the US. It opened in Beijing in 2008 and Abu Dhabi last year (for a review of the latter visit businesstraveller.com/tried-and-tested) and has just launched in Chennai and Bengaluru. Europe gets its first this month, in Brussels. “We’ll have 50 [properties worldwide] by the end of this year, and there are roughly 50 more signed deals,” says Brian McGuinness, senior vice-president of Starwood’s speciality select brands Aloft, Element and Four Points by Sheraton. They include one at London’s Excel, to open by early 2012, and three in India.

McGuinness says it’s “a good analogy” to say Aloft is somewhere between budget and four-star. So while you’ll find king-size beds, Bliss toiletries, 42-inch flatscreen TVs and high-tech “media hubs” to link your gadgets to the TV, you won’t get a minibar, room service or a full restaurant – instead there is a bar serving snacks and a 24-hour “grab and go” outlet. (Cultural adjustments are made – for example, in Abu Dhabi you’ll find an all-day diner and three bars).

McGuinness adds: “Our position is that the next generation of traveller doesn’t need a valet to park their car,” he says. “We look to the early adopter, the person with the iPad or iPhone, who likes design.”

Following Aloft out of the US is Hyatt’s limited service offering, Hyatt Place. With 156 properties stateside, it has 12 in the pipeline in India, with Pune to open in early 2012. Gebhard Rainer, Hyatt’s managing director for EMEA, says: “I think there is great potential for Hyatt Place in Western Europe, Africa and Russia. To launch it properly it makes sense to do three or four in one go – it’s very important to get a certain volume going. So in the UK that could be Edinburgh, Manchester, Glasgow, Aberdeen and Birmingham as well as London.”

Rooms have the same bed as Hyatt’s full-service brands, a “cosy corner” with a couch, and a 42-inch flatscreen TV to link your devices to.

The way forward?

So where will the sector go next? Perhaps Dutch brand Citizen M provides a blueprint. The funky hotel group, which has two properties in Amsterdam (see businesstraveller.com/tried-and-tested), is bringing its “affordable luxury” ethos to Glasgow this month, while two London properties – one on the South Bank and the other on top of Tower Hill station – are due to open in early 2012.

New York will also get two hotels – one “right on Times Square” at 50th and Broadway, says chief marketing officer Robin Chadha, and a second on the Bowery in the Lower East Side. The first is due to open by the end of 2012 and the second by the following year. Like Travelodge, Citizen M has been able to grab good sites as a result of the recession. “New York was a market that initially we wouldn’t have dreamt of going to but the crisis meant we could purchase land for less,” Chadha says. The group is also looking to expand in Milan, Paris and Zurich.

Amenities in Citizen M’s compact, well-designed rooms go far beyond a low-cost offering – super king-size, wall-to-wall beds dressed with Frette linens, high-tech “mood pads” controlling the lights, blinds, TV and temperature, bespoke toiletries, and free movies. (One thing missing in the Dutch properties was a proper desk, but Chadha says this has been added in Glasgow.) Meanwhile, the public areas feature retro custom-made furniture and quirky artwork. As Chadha puts it: “The only thing budget about it is the price.”

How Citizen M minimises costs is by building its bedrooms off-site, outsourcing the housekeeping and limiting the number of services – for example, it has a 24-hour canteen rather than a full restaurant. As a result, the 215-room Amsterdam City property employs only 20 full-time staff. Future hotels may feature upgraded facilities depending on the location – for example, a boosted food offering – but Chadha says “the DNA will stay the same”.

So maybe such innovation is the future for this part of the market. And what that should mean is that you can enjoy more of the facilities you’d expect from high-end hotels, without paying a high-end price.

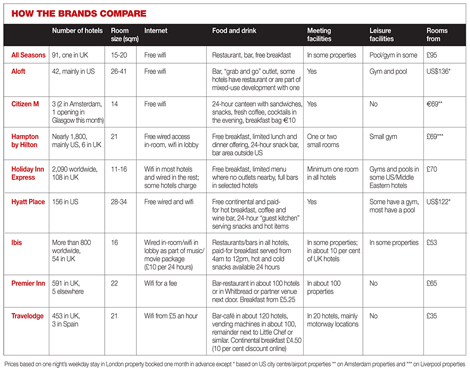

Click to enlarge