In one of the roundtable discussions at this year’s Aviation Outlook Asia, an annual conference held as part of the Travel Rave industry event in Singapore, the topic revolved around an emerging group of people that we will depend on one day. Increasingly affluent travellers from emerging economies? Think again. Aeronautic engineers working on next-generation aircraft? No, but one more chance. Larry Page, Eric Schmidt and Sergey Brin? Ok, this one is close enough. The answer is the millennials.

Millenials refers to people who were born after 1980 and they are increasingly becoming the backbone of the world’s workforce. So what are some of the general observations of this new breed of travellers? Several presentations throughout the event pointed to their tech-savvyness – some of them might not remember life without a mobile phone around – plus a tendency to want instant gratification and the habit of sharing their thoughts about a travel experience online, be it a negative or positive one. These opinions echo findings in a recent report by Deloitte, “Winning the Race for Guest Loyalty”, which asserts that millennials often view their phones as “an extension of themselves” and “use digital platforms to proactively, publicly, and compulsively share and engage with peers”.

The study also discovered that millennial frequent travellers are less focused on points earned from loyalty programmes compared to their counterparts from previous generations. Instead, they want more intangible perks such as VIP treatments and reward experiences, and they “like to wander off the beaten path in search of memorable or exclusive experiences that help establish individuality”.

But the moderator of the aforementioned roundtable discussion, Mark Rademaker from payment network UATP, raised a good question. “Is it a generation thing or an age thing? Which 20-something doesn’t want to go travelling and experience the world?” He also pointed out that millennials being internet-savvy is a generalisation. “There are people in their 40s and even 50s who are just as wired up.”

Even Emirsyah Satar, chief executive and president of Garuda Indonesia, paid heed to millennials in his presentation, highlighting that his country has a rather sizeable group of these up-and-coming travellers. “We have one of the largest, it’s in the top ten. They provide more fuel compared to other countries in terms of pushing the growth,” he said.

Satar did not elaborate on what his airline was planning to do to capture this audience, but he did note that while young Indonesians like their counterparts in many other countries are active online, they still prefer to use the service of traditional travel agents. He stopped short of providing a view as to the cause of this phenomenon, but one may surmise that the lack of a mature payment infrastructure in the archipelago may have hindered the popularisation of online transactions there.

Carriers based in countries with a more developed e-commerce culture, however, are responding to this new breed of travellers. “Increasingly, we are finding that millennial customers, aged between 16 and 34, expect real-time personalised service and quick responses to their online feedback and queries,” a spokesperson from Singapore Airlines says.

“Our official Facebook, Twitter, Google+, Instagram and You Tube channels enable us to have 24-hour engagement with our customers and we are encouraged by the feedback we have received,” they add.

But the airline is doing more than interacting with its millennials – it wants to get them to shop too. “Kris Flyer is reaching out to this group of people with more rewarding and relevant ways to earn miles. One of the ways is to tap into their interest in online shopping with our new portal, Kris Flyer Spree, where members can earn miles when shopping with more than 2,000 retailers all over the world listed on the site,” the spokesperson says, adding that roughly one-third of Kris Flyer members are millennials.

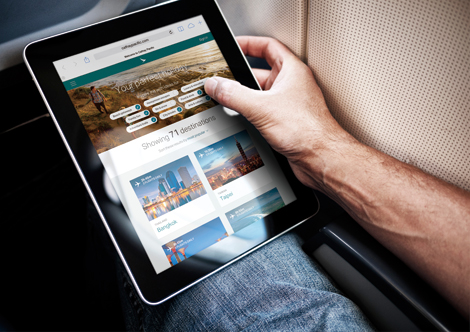

Hong Kong-based Cathay Pacific also recognises the millennial trend. “If we take ‘millennials’ to refer to people born after 1980, then we recognise this as an increasingly important market segment,” says Alex McGowan, general manager, sales and distribution at Cathay Pacific. “They have entered adulthood surrounded by personal technology that enables them to be connected wherever they are. We are certainly keeping them in mind as we develop our digital customer experience.”

McGowan explained that his airline has been actively enhancing its mobile platforms.

“We are turning the web experience into one that can be accessed and appreciated via a phone, tablet or PC. We do this by making sure we design the mobile interface first, knowing that all customers, led by the millennials, are increasingly engaging with us – and buying from us – using their phones,” he says.

Both Singapore Airlines and Cathay seem well informed in their strategies, as they are supported by independent research.

In a study conducted last April, consumer transaction technology provider NCR Corporation found that 68 per cent of millennial travellers would prefer an airline that offers the ability to purchase items like seat upgrades, checked baggage fees, in-flight meals, inflight entertainment, wifi and duty-free goods on their mobile devices or self-service kiosks over an airline that does not. While the sampling of this study is narrow – it is based in the US and millennials are defined as those aged 18 to 24 – it still demonstrates that future generations will be more inclined to make purchases online.

While airlines focus on making their online presence felt by the millennials, hoteliers are rebranding in an attempt to attract this new breed of traveller.

In September, a ribbon cutting ceremony saw the birth of Hotel Jen Orchardgateway Singapore, formerly a Traders hotel. The ceremony also kicked off a region-wide rebranding exercise that wraps up next March. Traders Hotel Cuscaden Road has already changed its name to Hotel Jen Singapore pending a major renovation project and Traders Hotel Hong Kong has also taken on the new brand identity. Properties in Brisbane, Penang, Johor Bahru, Manila, Maldives, Beijing and Shenyang will follow.

The brand also has an ambassador, a fictional character called – you guessed it – Jen. Walk into the elevator of any of the Hotel Jen properties – or just go on Facebook – and you will get an introduction. “Hi! I’m Jen. I’m a lover of life and adventure, of travel and discovery,” the jolly cartoon traveller proclaims. “I’m on my way across Asia-Pacific, bringing adventure everywhere I go.”

For those familiar with Traders, a solid and successful business hotel brand from hospitality group Shangri-La Hotels and Resorts, the move seems like a risky one. If it ain’t broke, why rebrand it?

Greg Dogan, the group’s president and chief executive, explains the rationale behind the initiative. “The Traders brand has had a 25-year history of success in generating solid business, carving out a niche amid a highly competitive industry and building a loyal base of customers,” he says.

“However, we are looking to the future and based on extensive consumer research and insight into the way our target market lives and travels, we are recognising and responding to the global travel trends and particular needs of this new generation traveller. This will keep us relevant and competitive for the next 20 years to come.”

Hotel Jen Orchardgateway, as the pilot property of the brand, offers a glimpse of where things are headed. Technology is high on the agenda, and other than high-speed free wifi, colourful mobile charging stations are found throughout the hotel and there are also iMacs for guests to use. Newspapers are replaced by the Pressreader app, which allows free access to some 2,500 online publications.

Shangri-La’s consumer research also seems to suggest that millennials do not care much about fancy valet service. Instead, Hotel Jen offers a wash and fold service at one price for an unlimited number of items placed in the laundry bag. Culinary requirements are covered by an all-day dining outlet and deli.

Concierge is replaced by the whole frontline staff, as explained in the press release: “The Hotel Jen team are local lifestyle experts catering to today’s most adventurous traveller, on-hand to recommend cultural spots, local cuisines and new places to explore off the beaten track.”

Lothar Nessmann, chief operations officer of Hotel Jen, says, “Catering to the changing demands of our existing customers and the more independently-minded ‘millennial’ mindset, the Jen brand offers travellers greater flexibility to blend the boundaries between business and leisure.”

The Shangri-La group is not the only one to address the requirements of the millennial traveller. At last October’s Hotel Investment Conference Asia-Pacific (HICAP) in Hong Kong, Carlson Rezidor announced the launch of a “lifestyle select” brand named Radisson Red, marked by a contract inked with an investor in Shenyang, China.

According to the official brand statement, the heart of Radisson Red “lies with the millennials, but its reach is far, far wider than a single generation.”

Thorsten Kirschke, the group’s president, Asia-Pacific, elaborates. “From a demographics point of view, they are traditionally defined as those born after 1981 or thereabouts. However, we look at millennial as a mindset rather than age-determined.”

He furthered that the brand is for “anyone who is internet savvy, has an integrated work-and-play lifestyle and an affinity with social online interactions.”

In Radisson Red hotels, guests will be greeted not by a big reception desk, but something called the Hi All Gallery, where they check in via mobile devices. Food and beverage outlets Ouibar, and the 24-hour Redeli, are presented as open and social spaces where guests can mingle.

“Guests can also choose to grab a sandwich and work in their room where instead of a conventional work desk, they have a multifunctional table where they can work, eat and surf the internet,” notes Kirschke.

These offerings seem to be in line with the thinking of James Stuart, managing partner of brand management consultancy The Brand Co. “What a millennial wants is an informal, buzzy, sociable, chilled place. Just look at some of the types of new eateries springing up in the region’s major cities. They have a certain cool down-to-earthness, where the design is stylish, but understated and occasionally quirky,“ he says.

“We have seen very few hotel equivalents of this in Asia, but I think we are going to see huge growth. Such hotels will see themselves as primarily social centres, with less emphasis on the guestroom and more on the spaces where people come together.“

Admittedly, the overarching idea behind these millennial-friendly brands is nothing new. Back in 2008, Starwood launched Aloft, which also emphasised modern design, streamlined amenities and open spaces conducive to social interaction. Pentahotels by Rosewood Hotel Group, as a “neighbourhood lifestyle” brand, is along the same vein. There are also hotel brands developed in this region based on a similar concept, such as Ozo by Thai hospitality group Onyx and Ovolo properties in Hong Kong.

And if one were to be a cynic, these new “millennial-minded brands” are just limited-service hotels with fancier décors. As a business concept it makes sense: the back of house is smaller, so the cost of running the property is lower; and at the same time, fancier design warrants a higher rate even with streamlined amenity offerings.

That said, the concept would not have been growing if there had not be demand to fuel it. It is the travellers who decide what works and what does not after all.