You may think you are fully insured for your business trips, but check the small print first, says Rose Dykins

As frequent flyers, we all have travel insurance. For some of us, it has been sourced and paid for by our employer, for others it is something we think about once a year when the premiums come up for renewal. How much has it gone up, have there been any changes to the cover, and has anyone told us about a better deal?For something that could save our lives, many of us are remarkably blasé about the subject – but then, that’s because we’ve never had to claim, or if we have, it was probably for lost luggage or a couple of nights’ emergency accommodation. Yet a good policy could see us being medically evacuated within hours of a serious accident and flown to a world-leading hospital, while an inappropriate one might see us paying hundreds of thousands of pounds for treatment or, worse still, being denied it.

Relying on your HR department

Larger firms ask a broker to assess their needs and put together a bespoke policy for them. It’s then down to a dedicated department – human resources or travel – to ensure staff are aware of the risks they face so they will know if the company cover needs to be extended. This means you don’t have to worry, right? Well, that’s unless you engage in an activity not covered by the policy, and which you should have told HR about, or worse, go off policy altogether (see overleaf for examples), which could include everything from enthusiastically enjoying the local nightlife to extreme sports.

Being your own HR department

What if you buy your own insurance? “With many smaller companies, it may well be that the individual employee is asked to arrange travel insurance and recover the cost of the premium via expenses,” says Jeff Rush, chief executive of Rush Insurance.

This is borne out by comments from readers on our online forum (businesstraveller.com/discussion). One poster, DavidGordon10, writes: “I work for more than one organisation and arrange my own travel insurance. I have a worldwide business travel policy from a well-known provider, and have had two occasions on which I’ve had to make a claim.”

So if it falls to you as the employee to find suitable cover for your trips – or as the employer to do so for your staff – how should you go about it? You may have travel insurance cover packaged with your credit card account. “The travel insurance policies that come with some of the big banking brands are very good, providing you’re travelling within their limits and restrictions,” says Rob Upton, director of sales and marketing for CEGA, which provides emergency assistance services for insurance companies. “If you go with a reputable brand name then you can usually know the products will be of high quality.”

The first thing to check is whether this policy – often packaged as being for the whole family – covers you for business travel at all. Don’t assume it does – many do not, and those that do won’t cover all jobs. One policy we read, for instance, has the following exclusion: “The insured person engaging during the period of travel abroad in manual work, in connection with a profession, business or trade, or in the supervision of such manual work unless this supervision be purely administrative as opposed to physical.”

Fine for pen pushers, but what is “manual” work? Would being a consultant trainer and being involved in a teambuilding game that goes wrong be covered? Perhaps.

Meanwhile, some cards only cover you if you have paid for your trip using the card, or only for certain elements under the insurance – perhaps for personal injury, but not lost baggage, for instance. So check the details – when it comes to lost luggage, one policy reads: “Cover is applicable to outbound journeys only, not when returning to the country of domicile.”

While you are reading the exclusions, check out obvious ones, such as war, civil unrest and the piloting of aircraft, but also bets, challenges and “well-known perilous acts”. That’s the end of arm wrestling then, or even a competitive early morning run with John from sales. Bear in mind that “inebriety” is also often included as an exclusion, and that one man’s inebriety is another man’s social lubricant.

American Express Platinum card insurance states that you will not be covered for “injuries or accidents which occur while under the influence of alcohol (above the local legal driving limit)”. In some countries, where the local legal driving limit for alcohol is zero, that may not be much of a reassurance.

One option is to buy a leisure policy with “business travel cover” as an add-on. But what does that include? “Nine times out of ten, these [options] just cover things like business equipment, or the costs of a replacement employee [in the event of illness],” Rush says.

Looking at the current business travel options of five leading UK insurance providers, for an annual multi-trip policy, this seems to be largely the case. For example, Aviva’s simply entitles you to the same cover as a leisure policy, extended for undertaking “office-based clerical and administrative duties for the duration of your trip abroad”.

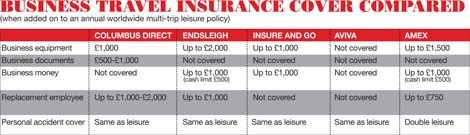

The others – Columbus Direct, Endsleigh, Insure and Go, and American Express – all offer cover for lost, damaged or stolen business equipment to values ranging from £500 to £2,000 (depending on the premium paid) – see the table overleaf for further details. American Express’s business travel add-on offers double the personal accident cover of that provided under a leisure policy (which varies depending on the premium), as well as personal assistance services such as advice about offices and conference space while abroad for up to £750. Add-on prices vary widely as they offer different amounts of cover for things like medical, cancellation and personal liability.

Depending on the nature of your trips, such a policy may be perfect for you. But if you’re regularly travelling to a high-risk country for specialist manual work, and for months at a time, a pre-existing policy cannot be expected to cater for all the risks you may encounter.

Such travel requires a made-to-measure policy. Steve Foulsham, head of technical services for the British Insurance Brokers’ Association (BIBA), says: “Going to a broker is the best way you can tailor-make the policy that’s actually required and, because of the complexity around the policy, it really needs some explanation. Brokers act as the agent – they are professional and they are regulated.” BIBA’s “find a broker” service is an online search tool (biba.org.uk) that allows you to find insurance brokers near you, and you can specify if you are looking for a business travel policy. Take such steps and they should make sure you are covered in your hour of need.What would happen if…

You fell down a flight of stairs while away on business after drinking at a reception. You broke your back and are hospitalised for a month. “Some policies are very strict and will exclude any losses that are a result of drug or alcohol use,” says CEGA’s Rob Upton. “A lot of insurers will ask the hospital to take a blood test when the patient arrives, then the result is assessed by medical experts back in the UK, and a decision is taken as to how much of a contribution the alcohol was.“Drugs are an absolute no-no. We’ve had some incidents where people have taken silly risks while being high and ended up paralysed. Families will phone us asking how much it will cost to get them home, and we’re talking about a figure that would perhaps need them to re-mortgage their house.”

BIBA’s Steve Foulsham says: “With alcohol, it’s a question of degree. If you’ve had ten pints, that’s one thing, but two or three glasses of wine at a business reception is slightly different. It’s about what’s reasonable and, in the main, most insurers would accept that people would enjoy a couple of drinks in that situation, so it would not adversely affect the claim. Unlike drink-driving, where there are actual measurements of alcohol-to-blood ratios that determine whether it becomes a conviction, there is no fixed figure with travel insurance policies.”You had to Unexpectedly rent a car in Italy and were involved in an accident. It wasn’t your fault, but motor accidents aren’t covered by your company insurance policy.

“Most travel policies would cover the medical expenses for any injuries sustained but they won’t cover the liability aspect of the accident itself – that comes under motor insurance,” Foulsham says.Upton adds: “Unless you’d taken the collision damage waiver out at the time you’d hired the car, then you’d pretty much be on your own. You’d have to stump up for the damage and then try to get it back yourself from the other driver if they were at fault. If you’re going abroad and expect to drive, there are policies you can buy in the UK that cover you for any hire vehicle throughout the year, so if you rent cars abroad frequently, you can buy an annual car hire insurance policy. If you have to hire a car unexpectedly, take the car rental company’s collision damage waiver.”

Jeff Rush warns: “Remember that collision damage waiver only covers your excess – it’s not a replacement for the medical section of your travel insurance.”You had a heart attack while abroad on business and died. Your last health check-up indicated that you had very high cholesterol, which you did not declare to your insurer.

“It’s all down to the individual terms and conditions of the policy,” Rush says. “If you’ve got a fit-to-travel policy and have it in writing that your doctor confirmed you were able to travel, that would comply with your policy, and your repatriation costs would be paid. If you didn’t know you had this pre-existing medical condition, then the costs would be covered. If you did know – if the policy said you would need to disclose your condition and you did not – then you wouldn’t be.”Foulsham says: “It depends on how related the heart attack was to the cholesterol diagnosis, and you would need medical evidence to understand that. But I think that initially, because it was a material fact that hadn’t been disclosed, many insurers will try to repudiate the claim.”

You spent a weekend in Geneva. You decided to go skiing, had an accident, incurred a head injury and had to be airlifted to hospital. You weren’t wearing a helmet. “Skiing is normally excluded unless the policy has a winter sports extension,” says Neville Hortas, development director at Giles Insurance [Brokers]. “Insurers are gradually introducing exclusions if you fail to wear a helmet [although the majority don’t have this currently], and the feeling is that within a year or so, it could become a condition on all policies.”Upton says: “If you decide to go seriously off piste or heli-skiing, quite often policies will exclude these unless they’ve been previously declared or accepted.

“While most policies will list things that are excluded, if you’re planning on doing a physical activity that could be perceived as risky – jet-skiing, white water rafting, scuba diving at certain depths – ring your insurer and double-check what your policy covers.” The Foreign and Commonwealth Office (FCO) advised against travel to a country unless essential. You went anyway, and civil unrest broke out. Your insurer only covers visits to “hot spots” if pre-notified, and then for a higher premium. You evacuated the country and cancelled a weeks’ worth of hotel stays. “If you travel against FCO advice and you have to curtail your trip for precisely the reason the FCO advised against, then I think most insurers would say: ‘Tough, you took that risk and we’re not paying out,’” Upton says.Rush agrees: “If you’ve got to pre-notify your insurer, then you’ve gone against policy conditions. If your employer says: ‘I don’t care what the travel policy says – get yourself out there, we’ve got a business to run,’ then that employer is taking responsibility, and the insurer no longer has anything to do with it.”

But Foulsham notes: “If you can demonstrate that you felt it was essential, then I think the insurer would have trouble refuting the claim. If it’s a business deal that you’ve been trying to put together for a long time, and you could only meet the client on a particular day, then perhaps you’ve got a case there. But if you are looking to take regular visits to high-risk countries, you need to take more care than you would otherwise.”